Meta Description

Ready to master your money? This ultimate guide to financial planning for young Indians breaks down budgeting, investing & tax-saving into easy, actionable steps. Secure your future today

**”Financial Planning for Young Indians: Master Your Money with this Ultimate Guide”**

**Introduction (The Hook)**

Does this sound familiar? Your salary hits your bank account on the 1st of the month, and by the 15th, you’re left wondering where it all went. You see friends on social media traveling, investing, and living their best lives, and you think, “When will I be able to do all that?” You are not alone. Millions of young Indians are struggling with this exact problem today.

* **The Problem:** The biggest mistake we make is not “planning.” We assume that financial planning is only for the rich or that you need to be a Chartered Accountant to understand it. This is the biggest lie.

* **The Promise:** After reading this guide to the end, you won’t just learn how to save money; you’ll learn how to make your money work harder than you do. You will take control of your financial future. You will get a clear-cut, step-by-step path on what you need to do today, tomorrow, and for the next five years.

* **A Sneak Peek:** In this guide, we will cover:

* Why financial planning is so crucial.

* The 5-Pillar Framework to manage your money.

* Your 7-Step Action Plan from Zero to Hero (from budgeting to investing).

* The biggest money myths that we will bust today.

* Practical tools and apps to make your journey easier.

Let’s take the first step towards your financial freedom!

**Why Financial Planning is Not a Choice, But a Necessity Today**

In our parents’ generation, one could get a job and retire from the same company. But things are different today. With rising inflation, changing lifestyles, and job uncertainty, depending solely on your salary is like navigating a storm in a boat without a life jacket.

Financial planning isn’t rocket science. It’s simply giving your money a plan today so that your tomorrow can be better. It’s the GPS for achieving your dreams—be it owning a home, a world tour, or a comfortable retirement. Without it, we’re just wandering aimlessly.

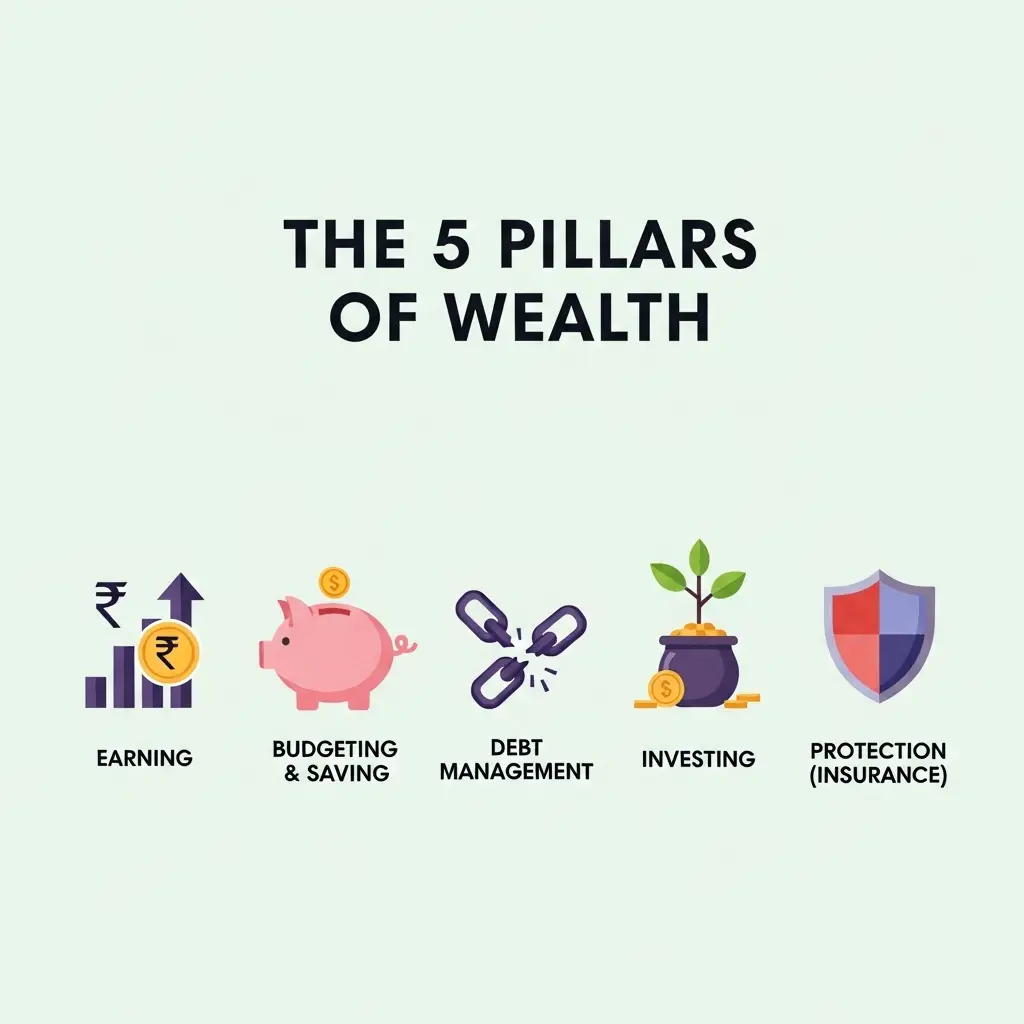

**Deconstructing Finance: The 5 Pillars of Wealth**

To simplify finance, let’s break it down into 5 pillars. Just as a strong building stands on these pillars, your financial health depends on them too.

**Pillar 1: Earning & Income Growth**

This is the engine of your financial life. It’s your salary, business profit, or income from a side hustle. The focus here isn’t just on earning, but also on **growing** your income by upgrading your skills.

**Pillar 2: Budgeting & Saving**

If earning is the engine, budgeting is the fuel that moves it forward. It decides where your money goes.

* **The 50/30/20 Budget Rule (Indian Version):**

* **50% on Needs:** Rent, groceries, utilities, transportation, EMIs.

* **30% on Wants:** Dining out, movies, shopping, gadgets.

* **20% on Savings & Investments:** This is the money that will create wealth for you. This is what will make you rich.

**Pillar 3: Debt Management**

Not all debt is bad.

* **Good Debt:** A home loan or education loan. It helps you build an asset or increase your earning potential.

* **Bad Debt:** Credit card debt or a personal loan for a vacation. It carries a very high interest rate and drains your wealth. Our first goal is to eliminate ‘Bad Debt’.

**Pillar 4: Investing**

Saving is putting money aside. Investing is putting that saved money to work. Your money works for you 24/7, even when you are sleeping. This is the true meaning of “making your money work for you.”

**Pillar 5: Protection (Safety Net)**

This is your financial safety net because life is unpredictable.

* **Emergency Fund:** What if you suddenly lose your job or face a medical emergency? This fund will come to your rescue.

* **Insurance:** Health Insurance and Term Insurance act as a financial shield for you and your family.

** Your 7-Step Blueprint to Financial Freedom: From Zero to Hero**

Now, we come to the most important part of this guide—your actionable plan. Follow these 7 steps at your own pace.

** Step 1: Assess Your Current Financial Health**

Before you set a destination, you need to know where you are right now. For this, we’ll calculate your **Net Worth**.

* **Simple Formula:** Assets (What you own) – Liabilities (What you owe) = Net Worth

* **Assets:** Bank balance, FDs, Mutual Funds, Stocks, Gold, Property value.

* **Liabilities:** Home loan, Car loan, Personal loan, Credit Card dues.

If your Net Worth is negative, don’t panic. This is just the starting point.

**Step 2: Create a Budget That You’ll Actually Stick To**

Start tracking your expenses using the 50/30/20 rule. Initially, use a simple diary or a notes app on your phone.

* **Pro Tip:** We’ve created a simple **Google Sheets Budgeting Template** that you can download and start using today.

**Step 3: Build Your Emergency Fund (The First Safety Net)**

This is your first financial goal. Set aside an amount equal to at least **3 to 6 months of your essential expenses** (Needs) in a separate savings account or a Liquid Mutual Fund. This money is not for investments. This is your ‘Break Glass in Case of Emergency’ fund.

**Step 4: Clear High-Interest Debt**

If you have credit card debt or a personal loan, make it your top priority to pay it off. Two popular methods are:

* **Avalanche Method:** Pay off the debt with the highest interest rate first. Mathematically, this is the best approach.

* **Snowball Method:** Pay off the smallest debt first. This gives you a psychological boost and builds momentum.

**Step 5: Start Your Investing Journey**

You don’t need lakhs to start investing. You can begin with just ₹500 or ₹1000.

* **For Absolute Beginners:**

* **Mutual Funds (via SIP):** Start a Systematic Investment Plan (SIP) to invest a fixed amount every month in options like a Nifty 50 Index Fund. It’s easy and diversified. *[We will discuss Mutual Funds in detail in our next article].*

* **Public Provident Fund (PPF):** A safe, government-backed scheme with tax-free returns. A great option for the long term (15 years).

* **After Gaining Some Experience:**

* **Stocks (Direct Equity):** Invest in well-established, blue-chip companies. This requires research.

**Step 6: Get the Right Insurance**

Insurance is for protection, not investment.

* **Health Insurance:** A basic health cover of ₹5-10 lakhs is essential, even if your company provides one.

* **Term Insurance:** If you have dependents, get a term plan that is at least 15-20 times your annual income. It provides financial security to your family in your absence.

**Step 7: Review and Adjust Your Plan (The Annual Check-up)**

Your financial plan is not set in stone. Review it every year. Increase your investments when your salary increases. Add new goals. It’s a living document.

**Actionable Checklist: Your First 7 Days**

> * **Day 1:** Calculate your Net Worth.

> * **Day 2:** Track all your expenses for one week.

> * **Day 3:** Open a separate bank account for your Emergency Fund.

> * **Day 4:** Research and compare one Term Plan and one Health Insurance plan online.

> * **Day 5:** Download an app like Groww, Zerodha, or Kuvera to explore Mutual Funds.

> * **Day 6:** Decide your first investment amount (even if it’s just ₹1000).

> * **Day 7:** Read this guide again and celebrate taking your first step!

**5 Financial Myths That Are Keeping You Poor**

1. **Myth: “Financial Planning is Only for the Rich.”**

* **Truth:** It’s like learning to ride a bicycle. You learn to ride not because you’re already a cyclist, but because you want to get somewhere. Planning is what helps you become rich.

2. **Myth: “I Don’t Have Enough Money to Invest.”**

* **Truth:** You can start with a SIP of just ₹500. Building the habit is more important than the amount.

3. **Myth: “I’m Too Young, I’ll Think About It Later.”**

* **Truth:** The greatest force in investing is the **Power of Compounding**. The earlier you start, the more time your money has to grow.

4. **Myth: “Keeping All My Money in an FD or Savings Account is Safe.”**

* **Truth:** With inflation at 6-7%, your FD/Savings account earning 3-5% is actually losing purchasing power every year. Your money isn’t safe; it’s shrinking.

5. **Myth: “The Stock Market is Gambling.”**

* **Truth:** Trading without research can be gambling. But investing in good companies for the long term is participating in the country’s economic growth.

**[Expert Quote Box]**

> “Financial expert Aman Sharma says, ‘People think of financial planning as a difficult exam, but it’s actually an open-book test. All the answers are in front of you; you just need the courage to open the first chapter. Your first step puts you ahead of 90% of people.'”

**[Mini Case Study] Riya’s Story: How a 26-Year-Old Graphic Designer Saved Her First ₹5 Lakhs in 2 Years**

Riya, a 26-year-old graphic designer, earned ₹50,000 per month but had nothing left by the end of it. She followed the steps in this guide:

* **Created a Budget:** Using the 50/30/20 rule, she found she was spending ₹8,000 monthly on impulsive online shopping and frequent Swiggy orders.

* **Set a Goal:** She decided to cut this expense and set a goal to invest ₹5,000 every month.

* **Took Action:** She started a ₹5,000 SIP in a Nifty 50 Index Fund.

* **Built an Emergency Fund:** She took on side projects and built a ₹1 Lakh emergency fund in six months.

**The Result:** In 2 years, her SIP investments (at a 12% average return) grew to over ₹1.4 Lakhs. She also invested her annual bonus in PPF. With a little planning, Riya created a net worth of **₹5 Lakhs** in just two years and feels financially confident today.

**Tools & Resources To Make Your Journey Easier**

* **Budgeting Apps:** Walnut, Spendee, YNAB (You Need a Budget)

* **Investment Platforms:** Groww, Zerodha Coin, Kuvera (for Direct Mutual Funds)

* **Insurance Comparison:** Policybazaar, Coverfox

* **Financial News:** Livemint, Economic Times, ET Money

**Frequently Asked Questions (FAQs)**

**How can I start investing with 1000 rupees?**

You can start a monthly SIP (Systematic Investment Plan) with as little as ₹1000 in a Nifty 50 Index Fund. It is the easiest and most diversified way for a beginner to start.

**What is the first step to financial planning?**

The very first and most crucial step is to track your expenses and create a budget. You cannot manage your money until you know where it is going.

**Is financial planning only for the rich?**

Absolutely not. It is for everyone. Financial planning is the path to becoming rich, not something you do after you are already wealthy.

**How much should I save for an emergency fund in India?**

You should aim to have an amount equal to 3 to 6 months of your essential living expenses (rent, groceries, EMIs, bills) saved in a separate, easily accessible account.

**Conclusion: The Final Motivation**

Congratulations! You’ve finished reading this guide, which means you’re already ahead of the 99% of people who only keep thinking about it. You have completed the hardest part of financial planning—**getting started**.

Remember:

* You don’t need to be an expert; you just need to **begin**.

* Take small, consistent steps. Your first ₹1000 SIP is a bigger win than a perfect but unimplemented plan.

* Don’t be afraid of making mistakes. They are part of the learning process.

* You have the power to achieve your dreams. Your money is your greatest tool.

Your journey to financial freedom is a marathon, not a sprint. And today, you’ve just crossed the starting line.

**Call-to-Action (CTA)**

Now it’s time to turn knowledge into action.

**What will be your first step? Share your #1 financial goal in the comments below! (e.g., #MyGoal is to start my first SIP this month).**

Let’s build a community of financial heroes, together.