Introduction: Turn Your Dreams into Reality

*Start investing in share market for beginners.

Learning how to “start investing in share market for beginners” can feel overwhelming, especially for young Indians from smaller towns. You might wonder how you’ll fulfill your dreams of buying a home for your parents, launching your dream startup, or securing your children’s future. We, especially the youth from small towns like Barsoi, Bihar, often think the stock market is only for the rich people in big cities. But that’s not true! I, a boy from Barsoi, who started investing with just ₹500 and built a capital of ₹50,000 in a few years, can tell you—you can do it too!

The first step feels scary. “Will I lose money?”, “I don’t even know the ABCs of the stock market!”—these questions cross everyone’s mind. But, if you start investing ₹1000 every month and get an average annual growth (CAGR) of 12%, it can become ₹2.5 lakhs in 10 years! This is the magic of compounding. This guide will show you an easy, step-by-step path to start investing in share market for beginners—especially for young Indians who want to achieve their big dreams from small towns like Barsoi.

“Start Investing in Share Market for Beginners with confidence—’The best time to plant a tree was 20 years ago; the second best time is now!’ – Chinese Proverb. Pair this with a vibrant image of a young Indian planting a sapling, symbolizing growth.”

Table of Contents

Table of Contents

- What Are Shares and Why Should You Invest?

- How Does the Share Market Work?

- Types of Shares: Which One is Right for You?

- How to Start Investing in the Share Market for Beginners: A Step-by-Step Guide

- Stock Selection Strategy: How to Invest Smartly

- Investment Strategies: Build Wealth for the Long Term

- Risk Management: Keep Your Money Safe

- Common Mistakes and How to Avoid Them

- Top Tools and Resources

- FAQ: Your Questions Answered

- Conclusion: Start Your Investment Journey Today!

What Are Shares and Why Should You Invest?

What are shares?

Imagine you buy a stake in the best grocery store in your village. If the store makes a good profit, you also get a share of it. Buying a share in the stock market is similar—you buy a small part of a company (like Reliance, Tata, or Zomato). If the company grows, the price of your share increases, and you make a profit.

Why should you invest?

- Wealth Creation: Inflation in India is rising by 6-7% every year (RBI data). Bank FDs offer only 5-6% interest, but the stock market has given an average of 12% CAGR over the last 20 years (BSE data, Nifty 50).

- Start Small: You can start with just ₹500—no large sum is needed!

- Turn Dreams into Reality: Whether it’s funding a sibling’s education, buying a two-wheeler, or a home for your parents—investing can help you reach these goals.

Example: “Meet Amit from Barsoi, who decided to start investing in share market for beginners with just ₹500. In two years, his smart choices in blue-chip stocks grew his investment to ₹20,000—proof that small steps lead to big wins!”

How Does the Share Market Work?

In India, the share market operates mainly on two exchanges:

- BSE (Bombay Stock Exchange): India’s oldest stock exchange.

- NSE (National Stock Exchange): Which has indices like the Nifty 50.

How does it work?

- Trading Hours: 9:15 AM to 3:30 PM (IST).

- Bull and Bear Market: When share prices are rising, it’s called a bull market; when they are falling, it’s a bear market.

- IPO (Initial Public Offering): When a company sells its shares for the first time.

You buy shares through a Demat account, and a broker (like Zerodha, Groww) executes the trades for you. It’s as easy as online shopping!

Types of Shares: Which One is Right for You?

India has three main types of shares:

- Blue-Chip Stocks:

- What are they? Large, stable companies like Reliance, HDFC Bank, or Tata Steel.

- Advantages: Low risk, regular dividends (a share of profits).

- Disadvantages: Slower growth.

- Example: Tata Steel, which is linked to industrial regions like Bihar.

- Mid-Cap Stocks:

- What are they? Medium-sized companies like Zomato or Indigo.

- Advantages: Good growth potential, moderate risk.

- Disadvantages: More volatile than blue-chips.

- Small-Cap Stocks:

- What are they? Small, emerging companies.

- Advantages: Potential for high returns.

- Disadvantages: High risk, volatile.

Tip: If you’re new, blue-chip stocks (like Infosys) are a great way to start investing in share market for beginners. As you learn, you can diversify into mid-cap and small-cap stocks.

Still with us? That means you’re curious and eager to grow your income. So, let’s get started!

How to Start Investing in Share Market for Beginners: A Step-by-Step Guide

“Ready to start investing in share market for beginners? Take our quick quiz: ‘Are You Ready to Invest?’ (Link to barsoitimes.com/quiz) and discover your investor personality in 2 minutes!”

Starting to invest is easy, even in small towns like Barsoi. Here’s a checklist:

- Open a Demat and Trading Account:

- Where? Online brokers like Zerodha, Groww, or Upstox.

- What do you need? PAN card, Aadhaar card, bank account, and a smartphone.

- Cost: ₹0 brokerage on delivery trades on Zerodha; account opening costs ₹200-300.

- Process: Download the app, complete your KYC (Know Your Customer), and your account will be ready in 24 hours!

- Create a Budget:

- Invest only with your surplus funds, like a Diwali bonus or savings from farming.

- ₹500-₹1000 is enough to start.

- Buy Your First Share:

- Log in to the Groww or Zerodha app.

- In the ‘Search’ bar, choose a company (e.g., Reliance).

- Click ‘Buy’, enter the amount (e.g., ₹1000), and select ‘Market Order’.

- Congratulations, you’ve bought your first share!

- Invest Regularly:

- Start an SIP (Systematic Investment Plan) of ₹500 every month.

- This allows you to benefit from rupee-cost averaging.

“Visualize how to start investing in share market for beginners with this infographic: 1) Open a Demat Account, 2) Set a Budget, 3) Buy Your First Share, 4) Track Progress. Download at barsoitimes.com/infographic.”

Tip: Watch YouTube tutorials from Groww and Zerodha that show their user-friendly interfaces.

Stock Selection Strategy: How to Invest Smartly

1. Fundamental Analysis (Check the Company’s Health)

- What to look for?

- Revenue Growth: The company’s income should be growing year-on-year (e.g., Infosys’s 10% annual growth).

- P/E Ratio (Price-to-Earnings): Compares the company’s share price to its earnings. A P/E ratio below 20 is often considered good, as it might indicate an undervalued stock.

- Debt-to-Equity Ratio: The company should have low debt.

- Where to check? Free data is available on Moneycontrol.com or Screener.in.

2. Technical Analysis (Understand Price Trends)

- What is it? Predicting future price movements by studying share price charts.

- Beginner Tip: Look at the 50-day moving average (on Moneycontrol charts). If the share price is above this line, it could be a sign of an upward trend.

Example: Rahul, a shopkeeper from Barsoi, invested in Tata Motors because the company showed strong growth. In 18 months, his ₹15,000 investment became ₹50,000!

Investment Strategies: Build Wealth for the Long Term

“Did you know? Starting investing in share market for beginners can beat inflation—India’s stock market has given 12% CAGR over 20 years! Click to see the full stat breakdown.”

- Long-Term Investing:

- Hold blue-chip stocks (like HDFC Bank) for 5-10 years.

- Example: Infosys has delivered a 14% CAGR over the last decade (BSE data).

- Diversification:

- Spread your money across different sectors (IT, FMCG, Banking).

- Example: With ₹5000, invest ₹2000 in Reliance (Energy), ₹2000 in Zomato (Tech), and ₹1000 in ITC (FMCG).

- Rupee-Cost Averaging:

- Invest a fixed amount (e.g., ₹1000) every month, regardless of whether the market is up or down.

- This allows you to buy more shares when prices are low.

Risk Management: Keep Your Money Safe

Some risks and their solutions:

- Market Volatility: Caused by global recessions or other factors. Solution: Invest only 10-20% of your capital in stocks initially.

- Tip: Set a 10% stop-loss order (e.g., if a share bought at ₹100 falls to ₹90, it gets sold automatically).

Case Study: Ramesh, a 22-year-old student, invested ₹15,000 based on a penny stock tip on X (formerly Twitter) and lost it all. Lesson: Always do your own research and trust SEBI-verified sources.

Common Mistakes and How to Avoid Them

- Emotional Trading: Don’t rush into decisions based on fear or greed.

- Example: Selling your shares when the market crashes.

- Solution: Stick to a long-term strategy.

- Unverified Tips: Avoid ‘multibagger’ stock tips from X or WhatsApp.

- Solution: Verify data from sites like Moneycontrol or the BSE website.

- Overtrading: Frequent buying and selling increases brokerage and taxes.

- Solution: Review your portfolio only 2-3 times a year.

Top Tools and Resources

- Trading Platforms:

- Data and Research:

- Moneycontrol.com: Real-time stock data and news.

- Screener.in: Detailed financial information on companies.

- Education:

- SEBI Investor Portal: Free guides at investor.sebi.gov.in.

- YouTube Channels: CA Rachana Ranade, Pranjal Kamra for videos in Hindi.

- Download: Get our free “Stock Market Checklist” PDF (barsoitimes.com/checklist) to track your investments.

“Watch this 5-minute video to start investing in share market for beginners: ‘Your First Stock Purchase with Zerodha’ on YouTube (link: barsoitimes.com/video-tutorial). Learn hands-on!”

FAQ: Your Questions Answered

Q1: How much money is needed to invest in the share market?

Answer: You can start with as little as ₹500. Platforms like Groww and Zerodha facilitate small investments.

Q2: Is it safe for beginners to start investing in the share market?

Answer: Yes, it can be safe if you do your research, choose blue-chip stocks, and invest for the long term.

Q3: Who are the best brokers for beginners?

Answer: Zerodha, Groww, and Upstox are best for beginners due to their simple interfaces and low fees.

If you’re reading this now, it means you’re still with us. And that says a lot. It means you are one of those who have a strong desire to make their future bright. Lets Investment.

“Excited to start investing in share market for beginners? Vote in our poll: ‘What’s your first investment goal?’ (House, Education, or Savings) at barsoitimes.com/poll and see what others think!”

Conclusion: Start Your Investment Journey Today!

People like us, from small towns like Barsoi, can also achieve great success in the stock market. This guide provides the roadmap you need to start investing in the share market for beginners—whether you’re investing your first ₹1000 or dreaming of securing your future. This Diwali, don’t just spend on firecrackers; invest in your future!

“Get started today—download our free ‘Start Investing in Share Market for Beginners Checklist’ at barsoitimes.com/checklist to track your investment journey step-by-step.”

Call-to-Action:

- Share your #FirstStockInvestment goal in the comments!

- Download our “Stock Market Checklist” from our website barsoitimes.com.

- Share this guide with your friends on WhatsApp and X.

- Subscribe to our newsletter (barsoitimes.com/newsletter) for weekly stock tips.

Internal Link: Learn more: The Complete Guide to Financial Planning in India

External Links: SEBI, BSE, NSE, Moneycontrol

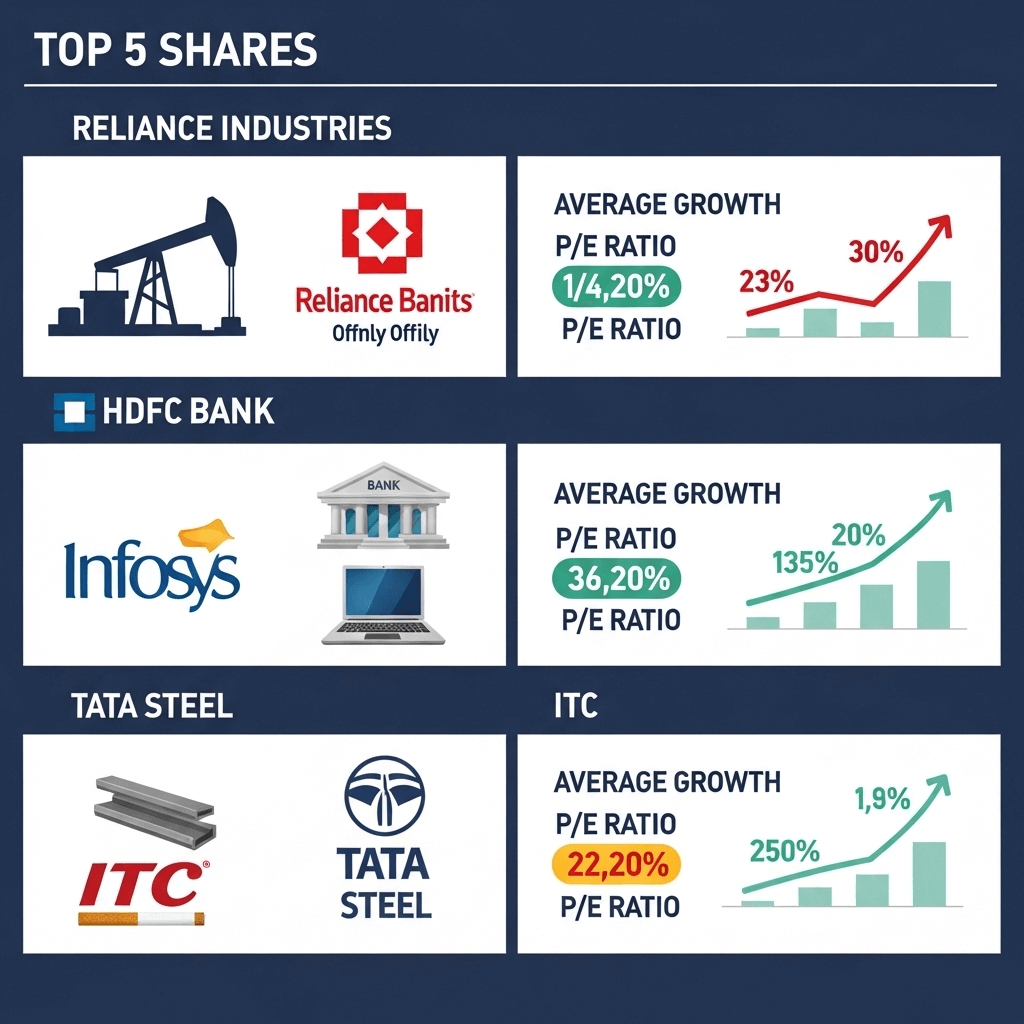

Table: Top 5 Stocks for Beginners

| Company Name | Sector | P/E Ratio | Average Growth |

| Reliance Industries | Energy/Tech | 22 | 12% |

| HDFC Bank | Banking | 18 | 10% |

| Infosys | IT | 24 | 14% |

| Tata Steel | Steel | 15 | 10% |

| ITC | FMCG | 20 | 8% |

“Take the 30-day challenge to start investing in share market for beginners! Invest ₹500, track it on our Portfolio Tracker (barsoitimes.com/portfolio-tracker), and share your progress with #FirstStockChallenge!”